THE MORAL LOW ROAD

2013 December 5

One of the cruxes of liberal attitudes

in my experience

has been a superior, sanctimonious, holier-than-thou attitude

that liberals are kinder, gentler, and fairer

while conservatives are nasty, mean, horrible people.

This attitude has spread throughout the west,

so my European friends are comfortable

judging left-wing and right-wing people

as left-wing generous and caring

and right-wing stingy and callous.

That American conservatives earn less and give more to charity

than American liberals is somehow lost in liberal discussion.

One of the cruxes of liberal attitudes

in my experience

has been a superior, sanctimonious, holier-than-thou attitude

that liberals are kinder, gentler, and fairer

while conservatives are nasty, mean, horrible people.

This attitude has spread throughout the west,

so my European friends are comfortable

judging left-wing and right-wing people

as left-wing generous and caring

and right-wing stingy and callous.

That American conservatives earn less and give more to charity

than American liberals is somehow lost in liberal discussion.

The American left assuages its conscience

by telling itself that its lack of personal commitment

to charitable causes

is justified by commitment to political charity.

Giving someone else's wealth to the needy,

in the form of "redistribution,"

is an acceptable alternative to personal sacrifice.

What is redistribution anyway?

It's the use of physical force and threats

to take one person's property and livelihood

for another person's benefit.

Whomever you believe that recipient to be,

the left-wing has decided

that taking wealth is justified.

Whatever happened to "Thou shalt not steal"?

Well, yes, maybe that's a good principle in theory,

but we have to deal with the practical reality,

the expediency of the moment.

There are people in need

and those deemed not in need should be

required to contribute.

It's the right thing to do, isn't it?

Isn't it okay to steal, or worse,

to justify a

better

outcome?

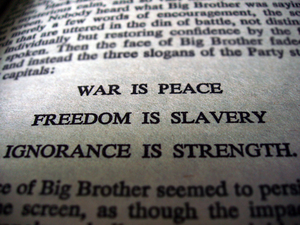

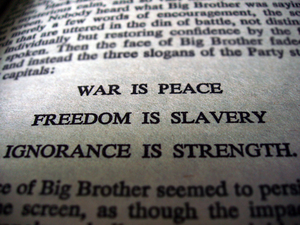

Don't the ends justify the means?

Liberal policies and programs are the moral low road.

They're the ends justifying the means,

taking from people,

hurting people,

and costing people their livelihoods

for the greater good of somebody else's need.

This attitude should scare the shit out of all of us.

We all seem to admit the necessity of taking wealth by force.

The Constitution of the United States

provides for taxation to support military defense and

the three branches of our government

(legislative, executive, and judicial).

Since we presumably benefit equally from having these basic services,

and since we all get an equal vote at election time,

we all pay the same amount.

It's equal payment for equal vote

for equal representation and equal benefit.

(In 1913 the

sixteenth amendment

violated that principle,

but that was the intent of the designers of our government framework.)

We all seem to admit the necessity of taking wealth by force.

The Constitution of the United States

provides for taxation to support military defense and

the three branches of our government

(legislative, executive, and judicial).

Since we presumably benefit equally from having these basic services,

and since we all get an equal vote at election time,

we all pay the same amount.

It's equal payment for equal vote

for equal representation and equal benefit.

(In 1913 the

sixteenth amendment

violated that principle,

but that was the intent of the designers of our government framework.)

One very nice side effect of this payment equality

is it keeps government small for two reasons.

First, a lot of people don't have a lot of money to pay in taxes

or would prefer not to pay a lot.

Second, since we're all paying the same amount,

any vote to raise taxes

is a vote to raise that voter's tax bill.

Isn't that nice?

That provides a steady downward pressure on the size of government.

Even with equal taxes,

there is still the option to decide,

perhaps just with a 51% majority,

to give tax money to people

who are not supporting the military defense

or any of the three branches of government.

Fortunately for those of us who don't approve, the

tenth amendment

specifically prevents the United States government from doing this,

although the individual states may do it.

So the governmental system in the United States,

while allowing the taking of individual wealth by force,

is deliberately and aggressively rigged to keep that theft small.

(This is often expressed in rhetoric-speak as,

"We don't live in a democracy where majority always rules,

we live in a republic where we have rules of conduct and

things we cannot vote to do, even with a majority,"

and I support that sound-bite version of it.)

So what happened?

First, the

sixteenth amendment

came along allowing one faction of voters

to raise some other people's tax without raising their own.

By taxing income rather than the right to vote,

we could decide that people of some income,

usually different from our own,

should pay a greater share of the burden.

Second, a strong sense of urgency was deemed important enough

to trump the limits of the

tenth amendment.

This mindset has been called "progressive."

Even with the progressive mindset in government,

there is still a strong moral imperative not to raise taxes.

It's still theft, after all.

When we vote to raise taxes,

we are still taking away people's property and their livelihoods.

"Thou shalt not steal" is still a potent prohibition

against taxing Peter to pay Paul.

But here's the rub in the moral imperative.

We can decide that there is a greater good,

beyond doing what is morally right,

beyond the prohibition on taking what belongs to somebody else,

beyond taking what that other person has worked for

and earned with his labor.

We may even decide there is a greater good

than the prohibition against

confining people against their will,

spying on them,

torturing them,

taking away their last morsels of food,

or even killing them.

These have been done in the name of greater good and

were done by political entities supported by American liberals,

some of these being

American

political entities.

The good news for the pro-morality, high-road people like me

is that a minimum-government America

has produced and will produce more wealth

at every place on the rich-to-poor spectrum.

Economic science and historical experience have repeatedly confirmed

that it's a myth that government regulation and redistribution

increase wealth at any rung of the economic ladder,

especially at the lower levels.

When President Wilson rejected

the "obsolete" Constitution he swore to uphold

and instituted taxes and programs to undermine

its even-handed tax fairness

(for the greater good, of course),

the left supported it,

the right opposed it, the left won,

the Progressive Era began,

and the corporations that produced America's wealth were demonized.

When President Wilson rejected

the "obsolete" Constitution he swore to uphold

and instituted taxes and programs to undermine

its even-handed tax fairness

(for the greater good, of course),

the left supported it,

the right opposed it, the left won,

the Progressive Era began,

and the corporations that produced America's wealth were demonized.

When Russia was in the throes of a revolution

(for the greater good, of course),

the American left supported the communists,

the right opposed them, the left won,

Nikolai Lenin rose to power,

then Josef Stalin came to power,

and eight million starved in the Ukraine.

When President Franklin D. Roosevelt recognized

a government role to ensure economic comfort

"from cradle to grave"

(for the greater good, of course),

the left supported it,

the right opposed it, the left won,

the New Deal began,

the Great Depression lasted an extra eight years,

and we are saddled today with massive federal bureaucracies

from that time.

(The Social Security program comes to mind.)

When central Europe was ceding power to the National Socialists

(for the greater good, of course),

the American left and Europeans supported the Nazis,

the right opposed them, the left won,

Adolf Hitler came to power,

a world war ensued, and 13 million died in gas ovens.

(In moral outrage to the war,

America's response was to incarcerate

its citizens of Japanese descent, not our finest hour.)

When President Lyndon B. Johnson waged a War on Poverty

(for the greater good, of course),

the left supported it,

the right opposed it, the left won,

the Great Society was formed,

and have a large, growing dependent class

which now constitutes 47% of America.

When so-called "minorities" decided they were entitled

to affirmative-action, preferential, discriminatory treatment

(for the greater good, of course),

the left supported it,

the right opposed it, the left won,

and now we have a generation of special-interest racists

who reject the notion that they have to earn their pay and position.

We now have a generation of people

who have been infantilized for a generation

and have ultimately become social and economic dependents,

and have become self-righteous about their entitlement.

When a worldwide community of government-funded scientists

created a culture of control over global warming

(for the greater good, of course),

the American left supported it,

the right opposed it, the left won,

and now we have a political eco-scare machine

with dire economic consequences

even when the underlying theory no longer has scientific basis.

(Environmental politics and eco-scare tactics have been around

since 1970 April 22, Earth Day,

but global warming seems to have a special role

in using these tactics to erode wealth and freedom.)

When the democrats in 2007 began programs of massive subsidies

to failing corporations

(for the greater good, of course),

the left supported them,

the right opposed them, the left won,

and we now have a culture of corruption and corporatism

that would make any military-industrial-complex conspiracy

look totally honest by comparison.

Starting in 2011

the Occupy movement on Wall Street and elsewhere

has been naked jealousy,

pure envy of people who have done better than the protesters

(for the greater good, of course).

The left supported them,

the right opposed them, the left won,

and we now have a ever-deepening culture of resentment and hatred

for the 1% who work harder, earn more,

and provide jobs for the other 99%.

Listen up!

The reason we have "high-road" morality

isn't because of some higher calling,

no matter what some religious folks would tell us.

It's because

good behavior creates good outcomes.

If killing, envy, stealing, adultary, and jealousy

made a better world,

then our morality would have embraced them,

in biblical times through the present day.

The number of times good ends justify bad means

is small enough that it just isn't the right way to go.

Suppose you still believe in low-road politics.

It's a "slippery slope."

Where does it end?

Every country in 2013 seems to be comfortable with taking people's

property and controlling their livelihoods, so that's okay.

What about spying on people?

What about putting people in concentration camps?

What about letting a few million people starve

so the rest have enough to eat?

What about killing a few million because you don't like them?

Where does it end?

Suppose you still believe in low-road politics.

It's a "slippery slope."

Where does it end?

Every country in 2013 seems to be comfortable with taking people's

property and controlling their livelihoods, so that's okay.

What about spying on people?

What about putting people in concentration camps?

What about letting a few million people starve

so the rest have enough to eat?

What about killing a few million because you don't like them?

Where does it end?

Let me suggest it should end with the minimum invasion,

an equal tax for equal protection and equal service.

We can have fees for services above and beyond.

That's what we need and that's what it takes.

(There are a few exceptions where I take minimum exception.

Until we can make these services private,

I'm okay with fuel taxes for transportation services

that are available to all who use the facilities.

I'm thinking of state sales taxes that directly support commerce.

I'm also thinking of property taxes for police protection and

other

community services that are roughly in proportion

to property held.

I'm sure there are other examples.

As for taking care of "the poor"

(whom our government programs haven't helped anyway),

our news, entertainment, and religious media

can create a community culture that castigates

cheapskates not contributing to charity.)

The first thing we have to do

is to reject the liberal low road

and decide we're going to respect the rules

decent people should live by.

If you want more of this kind of material,

then

here

are my American-issues essays.

THE ADAM HOME PAGE

adam@the-adam.com

One of the cruxes of liberal attitudes

in my experience

has been a superior, sanctimonious, holier-than-thou attitude

that liberals are kinder, gentler, and fairer

while conservatives are nasty, mean, horrible people.

This attitude has spread throughout the west,

so my European friends are comfortable

judging left-wing and right-wing people

as left-wing generous and caring

and right-wing stingy and callous.

That American conservatives earn less and give more to charity

than American liberals is somehow lost in liberal discussion.

One of the cruxes of liberal attitudes

in my experience

has been a superior, sanctimonious, holier-than-thou attitude

that liberals are kinder, gentler, and fairer

while conservatives are nasty, mean, horrible people.

This attitude has spread throughout the west,

so my European friends are comfortable

judging left-wing and right-wing people

as left-wing generous and caring

and right-wing stingy and callous.

That American conservatives earn less and give more to charity

than American liberals is somehow lost in liberal discussion.